One of the important concerns you will have as an entrepreneur will be getting the funds to help you grow and develop your business. In addition to choosing the right funding sources for the stage your business is in, it is also important for you to prepare for them. And this is what you will learn about from this material.

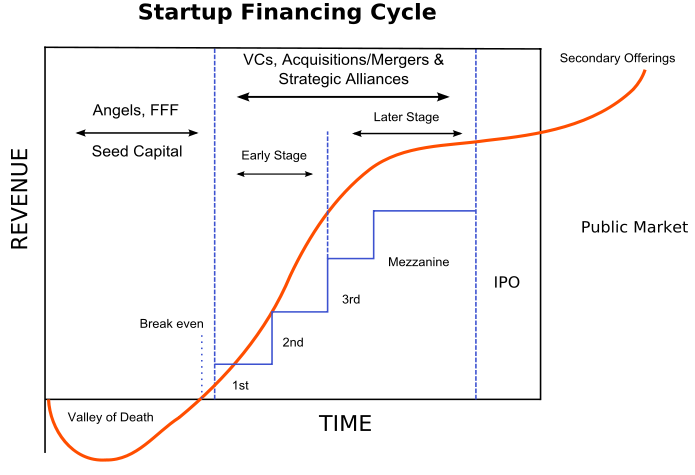

First of all, the right financing tools vary depending on the stage your business is in, as you have already found out from the first articles of this course.

For the very early stages, the classic funding instruments (such as bank loans for example) are not an accessible option. But there are some alternative tools: crowdfunding, competition prizes, non-refundable grants.

Secondly, before considering any traditional funding tools, you must honestly and fully answer the question: is lack of funds my main problem?

You are probably wondering why it’s important for you to ask yourself that. Well, because sometimes the pressure can make you skip other solutions that are more suitable for your situation. For example: let's say you need a man with a certain skill, but paying another salary will mess up your financial situation, and you're thinking about where you could get the money for it.

Here it would be worthwhile to first investigate whether the respective skill already exists in your team. You may need to redistribute/reallocate some roles so that someone on the team can learn and cover that need for a certain period of time. Or maybe you can work with an external supplier/freelancer for a limited period of time. Or maybe it would be best to hire someone who is a junior in the respective field, who can work for a remuneration to be received in the future or for some shares in your company.

Whatever your situation may be, you must first check all the possible scenarios. But if the situation is not that simple and you really need substantial financial resources to support your growth, here is what you should consider.

How to prepare for getting funding

-

Analyze the industry and environment in which your business operates. See what the trends that you have observed yourself are, what external reports anticipate and what the evolution during the last few years was.

-

Get to know very well every detail about your business: what the changes and opportunities are, what the activities that bring in the highest income are and what percentage they represent of your turnover;

-

Analyze your competition and how they position themselves by reference to your business. There may be things here that they do better that you can learn from. You can obviously learn from the experience and best practices of several industries, not just your own.

-

Choose wisely the people of your team. In a start-up, the skills/experience of the team members (which inspire confidence to your investors) and the shared vision and values that unite them are just as important.

-

Be aware of the changes that may occur and that you can anticipate. For example, think about the impact of losing your most important customer or your most important supplier. What are your actual chances of a comeback? What are the alternatives available to you?

-

Always follow the sales situation - which the channels you use are and what peculiarities each one has, what sales strategy your company has, how flexible they are, etc.

-

Pay attention to your cash flow.

-

Make sure that the financial statements are accurate, and that they reflect the truth about your company. Any investor or lender, regardless of their typology, will analyze them very carefully.

-

Work with a financial advisor. What I mean is that having a good accountant is not enough. You also need someone who can strategically look at the status of your company and with whom you can make plans for longer periods of time, i.e. 5 years and more.

How different funding tools can help you

-

Depending on the stage of your business, you can turn to funding from Business Angels, a type of funding usually accessed during the early stages of a business (seed and pre-seed). You can use the funds for product development, human capital and validating an MVP. And you can also access the knowledge of the investor: the consulting, business mentoring and growth management part. Obviously, this differs from person to person - it depends on how involved this businessman will be in working with you and what fee they will charge for the shared knowledge and expertise; they may even ask for a percentage of your company.

-

Investment funds (Venture Capital) can be accessed by your company when it gets to a more advanced stage. You can use them for marketing, trading, scale-up (seed and Series A, B, etc.). These funds earn money further from dividends, and then from the sale of the shares they hold in the company.

-

Factoring is suitable both to start-ups (during their first months of existence) and to larger and more experienced companies - it is a financial operation through which you can assign the receivables resulting from goods sale-purchase agreements or services agreements to a "Factor", a specialized factoring company (it can also be a division of a bank or a non-bank financial institution). This method has become almost necessary during the pandemic, for example, when the payment terms to suppliers have increased as a result of the issues faced with the selling to and payments from customers. Entrepreneurs can get a maximum of 80% of the invoice value through this type of product.

-

But bank loans are still the option that many entrepreneurs choose. As you have read in the previous article, the loans are granted under various conditions for the bank to make sure that it will get its money back.

Survival funding

In times of crisis, such as the COVID-19 pandemic, businesses in the affected industries can access support funding tools. But before making such a decision, the entrepreneur should know exactly to what extent the business is affected - is it completely or partially stuck? Does it need to reinvent itself? What is the biggest problem faced? Basically, the entrepreneur must objectively assess the situation they are in and what options they have.

Types of survival funding:

-

Non-reimbursable grants, depending on the industry

-

Unemployment benefits

-

IMM Invest program (which is essentially a state-guaranteed loan)

-

Loan installments deferred payment program